According to the World Health Insurance Organization, “Health is a state of complete physical, mental, and social well-being and not merely the absence of disease or infirmity”

Insurance – Insurance is a form of risk management that gives you protection from financial loss. In the insurance, a party agrees to compensate another party. The insurer party covers the loss, damage, or injury based on some premium of the policyholder. You can say this is a type of legal contract between an insurer and a policyholder.

Premium – The amount of money charged by the insurer to the policyholder is called the premium and the person who is paying a charge, is called the Policyholder.

Thomas Fuller said that “health is not valued until sickness comes.”

Virgil said – “The greatest wealth is health.”

Jim Rohn – “Take care of your body, it’s the only place you have to live.”

Health insurance – Health insurance is a type of insurance that covers the risk of a person incurring medical expenses. Sometimes people call it ‘medical insurance’ because it covers the whole or a part of any health risk. According to the Health Insurance Association of America, “ Health insurance is a policy which coverage that provides for the payment of benefits as a result of sickness or injury.

Most of the time an insurer generates an insurance agreement for the policyholder that provides a routine finance structure, such as a monthly, yearly, quarterly, or half-yearly premium system. By paying this premium the policyholder becomes able to get a medical insurance cover for future risk.

The benefits of health insurance are controlled and managed by central agencies, state agencies, cooperative agencies, non-profit organizations, and private agencies.

A German philosopher has said, “India is a rich country where poor people live”

We think he was right because india has many problems. As you know India is the largest country in the world by population But the people of india are tackling the low-income disease. People are saving their income for their whole life but suddenly an accident or disease can eat their income. Even sometimes indian take a loan from a moneylender or bank and get stuck in debt. Just imagine, you are going to your office, work purpose, School, Friend, or Relative house, and Suddenly a vehicle collides with you, and some injuries.

So, we can understand the unexpected turns and terms of life. Here we are going to know about the health insurance system in india.

In India, healthcare services depend on various factors. Two types of health insurance services are available in india- 1. Public health care system. 2. Private health services.

Due to the large population, it is hard to control and manage all health care by government is a very difficult task. So there are some private services also involved in this matter. The Insurance Regulatory and Development Authority of India and the General Insurance Corporation of India run many campaigns about healthcare but it looks like a drop in the ocean.

You will not remember any other government scheme after 2018 which is related to health insurance. Ayushman Bharat Yojana is a new health insurance scheme, which the Prime Minister of India funds. This scheme will try to cover more than 500 million people. This looks like a clumsy joke. You will have to roll papad as much as there is benefit in this plan.

Ayushman Bharat Yojana is also a type of health insurance that covers you, your family, Senior Citizen Insurance, Maternity Insurance, and Group Medical Insurance. It has fixed benefit plans. If you pay a fixed amount for Pre-decided diseases, Cancer, Heart disease, and many more.

Now we are going to private health services. If you are going to private hospitals for better treatment, you must fear about your bank balance. But you have to remember hospitalization charges, ambulance charges, day care charges, health checkups, and post-hospitalization charges. So you should consider the things before choosing health insurance in India:- Claim Settlement ratio, Insurance limits, Caps, Coverage, Network hospitals, and Service timing.

According to data, In 2018 there were 100 million Indians deprived of health coverage out of 500 million and another data says there are only 3.9% of India’s GDP was spent on health care in 2011. If look closely we find there are 1.3 billion potential beneficiaries of healthcare but there is no awareness, money, and risk management. So most indian are deprived of health insurance benefits.

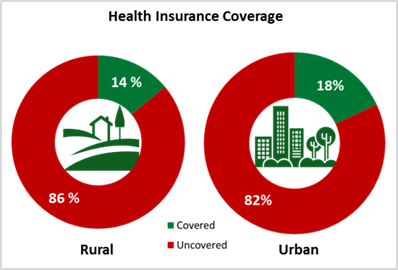

Based on the 71st round of surveys in 2016, NSSO released their report “Key Indicators of Social Consumption in India: Health” and the report says there are 80% of Indians are not covered under any health insurance plan. Only 18% of the urban population and 14% of the rural population have health insurance whereas the government funded 12% of urban and 13% for rural.

Here are the top 10 Health Insurance companies that provide better health care in India. According to the Insurance Regulatory and Development Authority of India (IRDA) in the financial year 201-20, these are the top companies:-

- IFFCO Tokio General

- Reliance General

- Bajaj Allianz General

- Bharti AXA General

- Universal Sompo

- HDFC ERGO

- ICICI Lombard

- Star Health

- Manipal Cigna

- Max Bupa

(Source – IRDAI Annual Report FY 2019-20)

Let us discuss these companies in detail:-

IFFCO Tokio General

IFFCO Tokio General Insurance Company Limited is a joint venture of IFFCO (Indian Farmers Fertilizers Cooperative Limited) and Tokio Marine Asia. It is non-govt. Company. It was established on 8 Sep 2000 and its headquarters is in Gurugram Haryana but its registered office is in Saket, Delhi. IFFCO Tokio General provides their services in multiple states of India like- Haryana, Uttar Pradesh, Himachal Pradesh, Tamilnadu, Jammu & Kashmir, Lakshadweep, Andhra Pradesh, and other states. The company offers insurance coverage for all customers. Tokio Marine Asia is the largest health insurer in Japan

Note:- The company has 40000 Lakh authorized capital according to the Ministry of Corporate Affairs. After much research, it’s proved that the company has currently 7000+ hospital networks and a 92% claim settlement ratio.

Reliance General

Reliance General Insurance Company is a limited healthcare company in India. It is a part of Reliance Anil Dhirubhai Ambani group and was established on 17 August 2000. Also, the headquarters of this company is in Mumbai. Unlike in India, most insurance companies have foreign partners but this company is a wholly owned subsidiary of Reliance Group. This company provides toor and trip services also in Asia and Europe.

Note:- The company has 19 thousand crore authorized capital according to their annual report that’s submitted to the Ministry of Corporate Affairs. After research, it’s proved that the company has currently 8000+ Hospital networks and a 95% claim settlement ratio.

Bajaj Allianz General

Bajaj Allianz General Insurance Company is a joint venture of Bajaj Finserv Limited and Allianz SE. Allianz SE is a German financial Service provider company and Bajaj is a top-class industrial manufacturer in India. Its headquarters at Pune, Maharashtra and its have 11 regional office in India. This company was founded in the year 2001 and the company claims it has 10 crore customers only in health insurance service. This company has exceptional work because it is the first company that provides health guards, silver health, and star packages.

Note:- The company has 82.072 crore authorized capital according to their annual financial report that’s submitted to the Ministry of Corporate Affairs. After research, it’s proved that the company has 7000+ Hospital networks and an 85% claim settlement ratio. This company claims another leverage thing that is – the company can provide settlement just in an hour.

Bharti AXA General

During the second wave of growth in private insurance Bharti AXA Life Insurance was formed. It becomes the booster after it commences business operation because it is owned by Bharti Enterprises and AXA Group Paris. It is a joint venture of both companies and 51% stake is owned by Bharti Enterprises and 49% by AXA Group Paris. This company has two great visionaries, Bharti Group, and AXA they together bring a rich culture that forms the essence of Bharti AXA Life Insurance.

Note:- The has an estimated 41 thousand crore authorized capital according to their annual financial report that they provided on their official website. After research, it’s proved that the company has 5700+ Hospital networks and an 83% claim settlement ratio. The company claims it provides 27×7 customer service.

Universal Sompo General Insurance

Universal Sompo General Insurance Company is a Japanese insurance company that provides health insurance in India. After Tokio Marine, it is the second largest insurance company in Japan. It is an ancient insurance company that was established in 1887 as Tokyo Fire Insurance Company but in the year 2002 it merged with Nissan Fire and became famous as Universal Sompo. The word ‘Sompo’ refers to general insurance and Universal represents ‘service is worldwide’. In the year 2008, Universal Sompo General Insurance Company came to India and started its joint venture with Karnataka Bank. After the merger of Indian Overseas Bank and Allahabad Bank and the formation of Indian Bank, Universal Sompo started working with them.

Note:- This company has an authorized capital of 4167 billion dollars, according to their annual financial report for 2022. As we know it is a Japanese company so its main headquarters at Tokyo but its indian headquarters is also in Mumbai. After research, it’s proved that the company has 7500+ Hospital networks and an 82% claim settlement ratio.

HDFC ERGO

First of all, we want to clarify, that HDFC ERGO does not represent HDFC Bank. HDFC ERGO is a joint venture between an Indian insurance company (HDFC-Housing Development Finance Corporation) and a German insurance company (ERGO), which is one of the largest insurance companies in Europe. There is a partnership of 51:49 between HDFC & ERGO. For better information, you can consider that HDFC (Housing Development Finance Corporation) was established in 1977 in Mumbai and merged with ERGO (a German insurance company) in the year 2015. So you can say this is not older but its service is amazing nowadays.

Note:- This company has an authorized capital of 32,118 crore, according to their annual financial report for 2022. After research, it’s proved that the company has 10000+ Hospital networks and a 75% claim settlement ratio. You can see that this company has a lot of network of hospitals but its claim settlement ratio is not encouraging. But in just 7 years it got 6th position in the list of IRDA (Insurance Regulatory Authority of India), it is amazing because of its service.

ICICI Lombard

It is good to see ICICI Lombard on this list as it is a joint venture between Fairfax Financial and ICICI Bank. According to reports in the year 2023, ICICI Bank is the second largest bank in India after HDFC Bank. This insurance company claims it has 217.7 billion Gross Written Premium. The company does not provide only health insurance but also travel insurance, car insurance, home insurance, and weather insurance. Another thing about this is that ICICI Bank has a 64% stake and Fairfax Financial has only a 36% stake. The company was established in the year 2001 and in just 22 years its business strategy has made it India’s No. 1 private insurance company.

Note:- This company has an authorized capital of 50,848 crore, according to their annual financial report for 2023. After research, it’s proved that the company has 7000+ Hospital networks and a 73% claim settlement ratio. The company is led by ICICI, India’s second-largest bank, which makes it more trustworthy. The main headquarters of this company at Mumbai.

Star Health Insurance

Star Health Insurance has a slogan that is health insurance specialist for personalized and caring, it is nearly true. This company has multiple insurance services like, – Health, Travel, and Car but one thing that makes it different from other insurance companies, is bancassurance. This company was established in the year 2006 its headquarters is in Chennai. This company provides its services directly as well as with the help of various channels like – agents, brokers, and online. This is no different from other companies as you can see all Indian companies doing this.

Note:- This company has an authorized capital of 13,513 crore, according to their annual financial report for 2022. After research, it’s proved that the company has 9000+ Hospital networks and a 70% claim settlement ratio. This is a growing company as you can see, it was only 17 years old and it has 9000+ hospital networks.

Manipal Cigna

Manipal Cigna is a health insurance company with a complete healthcare insurance plan for lower to upper people. This company protects and improves your financial, physical, or emotional health. The company has a slogan ‘Helth hai to life hai.’ This is a new and growing company so you must choose wisely. This company has an excellent award ‘Best Health Insurance Company’ by “The Future of Insurance Summit & Awards2023”

Note:- This company has an authorized capital of 20,000 crore, according to their annual financial report for 2022. After research, it’s proved that the company has 6000+ Hospital networks and a 65% claim settlement ratio. This company was established in the year 2012.

Max Bupa

Max Bupa is a joint venture of Max Group of India and Bupa Health Insurance Company of Britain. Max Group is an Indian conglomerate (Means Group of Stakeholders and Ventures) headquartered in Delhi, established in the year 1998. Bupa (British United Provident Association Limited) is a British multinational health insurance company that has 43 million customers all over the world. Max Group of India and Bupa became a joint venture in the year 2008 and started operations in 2010. This is also a highly growing company so you can take any plan from it. If you are looking at Niva Bupa then do not be confused because, in the year 2019, Bupa completed its transition with a new partner ‘True North’. So sometimes it shows as Niva Bupa, don’t be confused.

Note:- This company has an authorized capital of 13500 crore, according to their annual financial report for 2023. After research, it’s proved that the company has 5500+ Hospital networks and a 63% claim settlement ratio. The company was established in 2008.

FAQ

What should be kept in mind while taking health insurance?

Here are some important things that you should keep in mind while taking health insurance –

- Terms and conditions of the company.

- Market reputation of the company.

- Premium fee and charges.

- Hospital Network availability

- Claim Settlement Ratio.

Which one is a better health insurance company, Public or Private?

After a good research, the most important information is given above but even after that if you are going to ask then pay attention –

- Government scheme is cheap but taking the benefit of that it looks like black and white on paper.

- Private health insurance is good but its dependency on hospital availability makes it frustrating.

- Kindly check faster and more service providers. It is very helpful for your health insurance plan.

Is it necessary to take a health insurance plan?

Possible Yes! If any unexpected event happens you will lose all your income. Health insurance becomes a safety valve for your heirs so opt for it and choose plans as per your income, life balance, and expected events.