Contributing shrewdly is pivotal for long-term budgetary development. Expanding diminishes the hazard of being excessively subordinate to a single speculation or industry. This approach makes a difference in ensuring your portfolio from showcasing instability and potential misfortunes. Moreover, differences make a difference for you to capitalise on different showcase patterns and openings, boosting your chances of accomplishing reliable long-term returns.

By apportioning your speculations over different resource classes, you make a strong speculation biological system that can climate advertise changes. When one division encounters a downturn, other segments may proceed to perform well, relieving misfortunes. Additionally, enhancement can assist you capitalize on distinctive financial cycles.

For case, amid periods of financial development, stocks, and genuine domain speculations may flourish, whereas amid financial downturns, bonds and valuable metals might serve as a secure sanctuary. It’s fundamental to routinely survey and rebalance your portfolio to preserve expansion and adjust it together with your changing financial goals. Remember that differences do not ensure benefit or watch against misfortune, but it may be an astute approach for boosting your venture potential and progressing your generally money-related solidness.

1. Wisely: Diversify Your Portfolio for Long-Term Growth

Contributing with a different portfolio not as it diminished chance but moreover gives openings for long-term advancement. By distributing your speculations over different resource classes, you make a strong speculation biological system that can climate advertise variances. When one segment encounters a downturn, other segments may proceed to perform well, relieving misfortunes. Additionally, enhancement can assist you capitalize on distinctive financial cycles.

For illustration, amid periods of financial development, stocks and genuine bequest speculations may flourish, whereas amid financial downturns, bonds and valuable metals might serve as a secure safe house. It’s basic to routinely survey and rebalance your portfolio to preserve broadening and adjust it along with your changing financial goals. Remember that differences do not ensure benefit or protect against misfortune, but it may be an astute approach for expanding your speculation potential and moving forward your generally money-related soundness.

2. Save Strategically: Build an Emergency Fund for Financial Security

Sparing deliberately and building crisis support may be an imperative step towards accomplishing monetary security. Crisis finance serves as a security net to secure you from unforeseen costs or pay disturbances. To spare deliberately, begin by setting a reasonable investment funds objective based on your month-to-month costs and monetary commitments.

Endeavour to spare three to six months’ worth of living consumptions. Set up programmed exchanges from your checking account to a partitioned reserve funds account to automate your reserve funds. This restrained approach guarantees simply reliably contribute to your crisis support. Furthermore, seek ways to trim superfluous costs and divert those reserve funds towards your crisis support. By having a well-funded crisis finance, you’ll confront startling money-related challenges with certainty and dodge falling into obligation or depending on high-interest advances.

Building crisis support may be a keen budgetary move that gives solidness and peace of intellect. Amid times of emergency, such as startling therapeutic costs or work loss, having well-padded crisis finance can assist you to explore troublesome circumstances without bringing about over-the-top obligations or compromising your money-related objectives. It serves as a budgetary pad, making a difference for you to meet fundamental bills and protect your level of life amid troublesome times. Consider putting your crisis cash in a high-yield reserve funds account or cash advertise finance with competitive intrigued rates to maximize its growth.

Regularly audit and reassess your reserve funds methodology to guarantee you’re reliably contributing to your crisis support and altering it as your financial circumstance advances. Keep in mind that making crisis support may be a ceaseless commitment to your budgetary well-being. By sparing deliberately and building robust crisis finance, you’ll accomplish more prominent money-related security and be arranged for any unforeseen money-related obstacles that will come your way.

3. Pay Off Debts: Reduce Financial Burdens and Improve Credit Score

Paying off obligations could be a significant step toward lessening budgetary burdens and progressing your credit score. Tall levels of obligation can weigh you down and constrain your budgetary flexibility. By implementing a vital obligation reimbursement arrangement, you’ll be able to recapture control of your accounts and reduce the stretch related to obligation.

Begin by organizing your obligations, prioritizing those with the most noteworthy intrigued rates or the biggest equalizations. Consider utilizing the obligation snowball or obligation torrential slide strategy to methodically handle your obligations. Making steady, on-time installments towards your obligations not as it were diminishes the principal sum owed but too makes a difference progress your credit score over time.

The next credit score can open doors to superior intrigued rates on advances, credit cards, and indeed potential lodging openings. Also, look for openings to extend your pay or cut costs to quicken obligation reimbursement. By being proactive and restrained in paying off your obligations, you’ll be able to accomplish budgetary opportunities and lay the establishment for a more beneficial budgetary future.

Lessening obligation burdens and progressing your credit score are interconnected budgetary objectives that require cautious arranging and tirelessness. Prioritize making more than the least instalments on your obligations at whatever point conceivable, as this will assist you to pay off the central sum quicker and decrease the general intrigued paid. Also, consider arranging with leasers for lower intrigue rates or investigating obligation solidification alternatives to disentangle your reimbursement preparation.

As you constantly reimburse your obligations, your credit score will steadily move forward. A better credit score reflects your capacity to oversee obligation dependably and makes you a more alluring borrower to loan specialists. Keep in mind to frequently screen your credit report for inaccuracies and take vital steps to debate any blunders. You will recoup monetary control, appreciate diminished intrigued rates, and clear the street for a more secure monetary future by forcefully paying off obligations and centring on expanding your credit score.

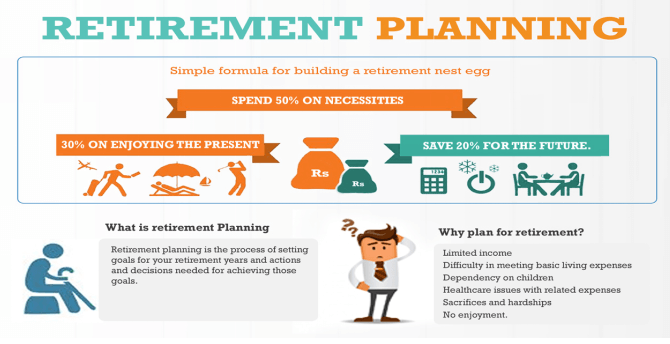

4. Plan for Retirement: Secure Your Future with Smart Retirement Contributions

Arranging for retirement is fundamental to securing your future, and savvy retirement commitments play a pivotal part in accomplishing this objective. You’ll create a significant settlement egg for your senior for a long time by beginning early and persistently contributing to retirement stores such as a 401(k) or a Person Retirement Account (IRA). Start by evaluating your retirement needs and setting a practical investment funds target. Consult a financial counsellor to set up the right commitment sum based on your pay, investing, and retirement destinations.

Take advantage of any employer-sponsored retirement plans, ‘’Dubai E-commerce’’ particularly in the event that they offer coordinating commitments, as typically basically free cash. In the event that is conceivable, contribute the greatest permitted by the arrangement to maximize your retirement investment funds. Examine the preferences of a Roth IRA, which permits tax-free withdrawals in retirement. By making savvy retirement commitments and taking advantage of tax-advantaged accounts, you’ll guarantee a monetarily secure future for yourself.

Securing your future requires proactive arranging, and making savvy retirement commitments could be a basic component of this process. It is never as well early to start sparing for retirement, since compounding may significantly boost your investment funds over time. By making nonstop commitments to retirement accounts, you permit your speculations to develop and compound, expanding your riches exponentially. To expand your reserve funds, take advantage of the charge points of interest related to retirement commitments, such as tax-deferred development and potential assessment findings.

Routinely audit and alter your retirement commitments as your monetary circumstance advances, such as getting a compensation increment or encountering major life changes. Expand your retirement portfolio by contributing a combination of stocks, bonds, and other resources based on your hazard resistance and retirement time allotment. Consider talking with a money-related master as you approach retirement age to guarantee your reserves are adjusted along with your planning retirement way of life. By arranging for retirement and making shrewd commitments, you’ll appreciate a comfortable and fiscally secure future.

5. Educate Yourself: Increase Your Financial Understanding in Order to Make Informed Decisions

Instruction is a powerful catalyst for broadening one’s money-related intelligence and inciting educated choices that hold the potential to promote one’s monetary well-being. Ok, plan yourself, expensive per user, for a journey of edification as you set out upon the perplexing domain of cash administration. Prepare yourself with a treasure trove of information by drenching in a cornucopia of assets – books, podcasts, and online courses – that span the endless scene of money-related shrewdness. Dig into the creativity of budgeting, the charm of contributing, and the sensitive move of obligation management.

Inundate yourself with the significant complexities of budgetary concepts: the divination of compound intrigued, the sensitive adjustment of chance resistance, and the key ensemble of resource assignment. Ace these principles and the world of the back should bow some time recently, rendering you the architect of shrewd monetary choices that harmonize with your most profound yearnings.

But lo, don’t vacillate within the interest of edification! Remain forever watchful, my expensive companion, tuned in to the steady flux of money-related news and patterns that shape the financial scene For within the information of advertise conditions and financial changes lie the keys to shielding your treasure trove of riches. Let your money-related understanding advance, morphing into an effective constraint that empowers you to observe the pearls in the midst of the tremendous ocean of venture openings, shield yourself against the rough tides of monetary hazard, and fastidiously manufacture a path toward sustained budgetary triumph.

Keep in mind, expensive searcher of monetary liberation, that the speculation made in your budgetary instruction is of no unimportant use. Nay, it could be an unflinching venture within the sacredness of your future, a confirmation of your immovable commitment to the thriving that is standing by you.